As we head into 2025, the U.S. housing market is expected to show signs of gradual improvement, though some challenges remain. Here’s a look at the key trends shaping the year ahead, backed by insights from industry experts. This is, of course, a broad-based look at the NATIONAL market; local considerations need to be examined which will adjust the South Bay outlook. Contact us directly to discuss the local market forecast for 2025.

Home Sales Expected to Increase

According to HousingWire, existing home sales are forecasted to rise by 5%, reaching approximately 4.2 million transactions. While this marks a positive step forward, it’s still below the long-term average of 5.15 million annual sales over the past two decades.

Mortgage Rates to Remain a Key Factor

Mortgage rates are expected to remain elevated, fluctuating between 5.75% and 7.25%. This continues to impact affordability for many buyers, limiting their purchasing power and potentially slowing demand. (Source: HousingWire)

“Yun addressed mortgage rates during a second Donald Trump presidency, saying, “Mortgage rates in his first term (at 4%) were the good old days. Are we going to go back to 4%? Per my forecast, unfortunately, we will not. It’s more likely that we’ll go back to 6%. That will be the new normal, bouncing around 5.5%-6.5%.” – NAR Chief economist Stephen Yun, as quoted in National Association of Realtors article.

Home Price Growth to Moderate

HousingWire reports that home price appreciation is anticipated to slow to around 3.5%, down from the typical 5% growth seen in past years. This more balanced growth offers some relief to buyers who have faced significant price increases in recent years.

“Yun projects new home sales to be 11% higher in 2025 and 8% higher in 2026. Yun forecasts the median home price to be 2% higher in both 2025 and 2026.”

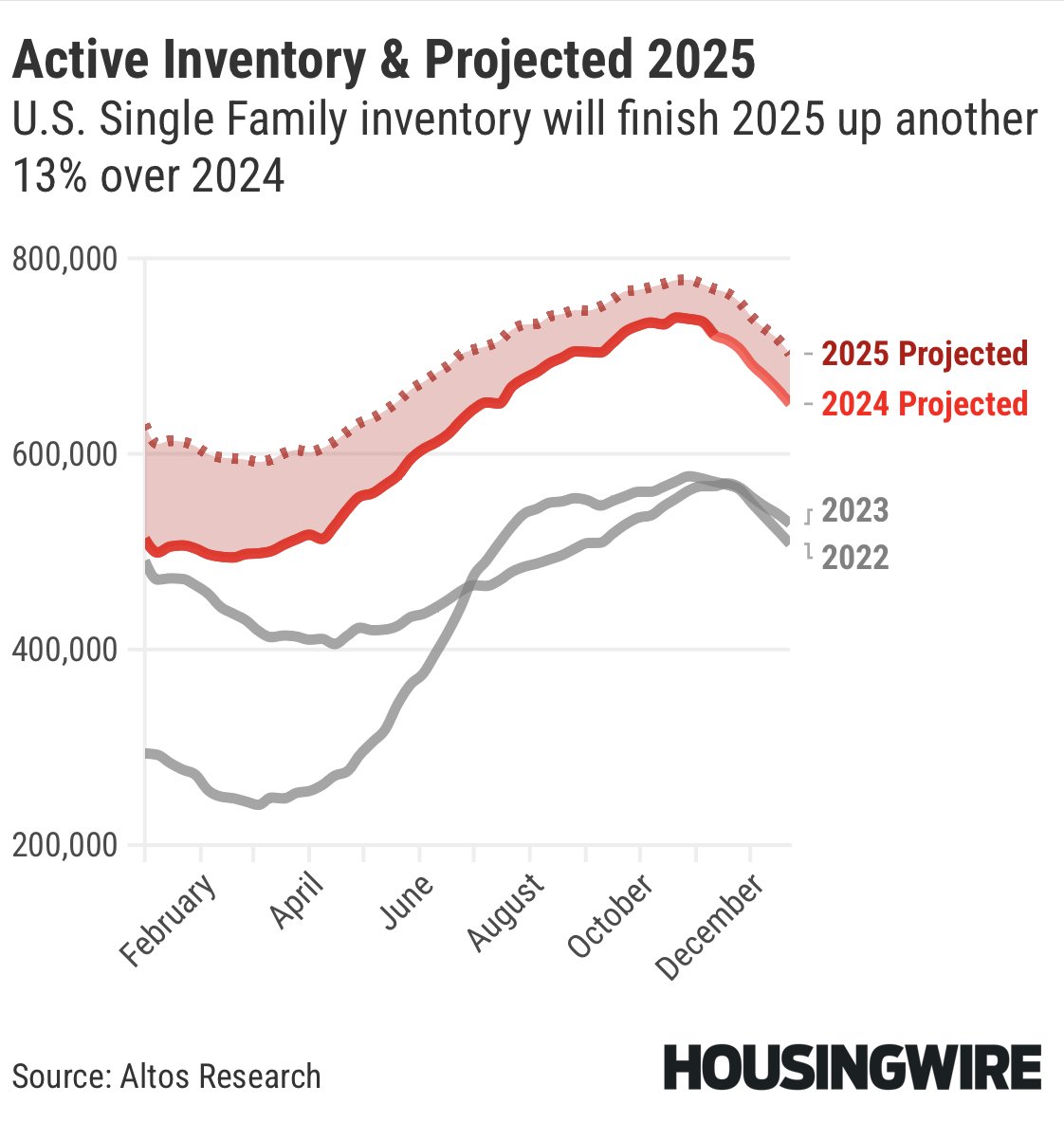

Inventory Slowly Improving

The market will see a slight improvement in inventory, with a projected 13% increase in available homes. Inventory is expected to peak at nearly 800,000 unsold single-family homes by October, before ending the year at approximately 720,000 homes. However, these gains will still fall short of bridging the gap between supply and demand. (Source: HousingWire)

Industry Consensus

The National Association of Realtors (NAR) and Fannie Mae have echoed similar forecasts, emphasizing modest gains in home sales and price growth for 2025. Their projections align with HousingWire’s, further highlighting the impact of affordability challenges on market activity.

A Balanced Outlook

While the 2025 housing market is expected to see incremental improvements in sales and inventory levels, affordability remains a pressing issue. With mortgage rates staying elevated and supply constraints still a factor, buyers and sellers alike will need to navigate the market with patience and strategy.

This post provides a forward-looking perspective on the housing market, drawing on trusted industry sources like HousingWire, the National Association of Realtors, and Fannie Mae. If you’re considering buying or selling a home in 2025, reach out to our team for personalized advice tailored to the evolving market trends.